Mr. Paul Schulten is asking me the following:

“It is true that delinquencies and losses in residential mortgage backed securities (RMBS) are strongly correlated with home price appreciation (HPA) or in the current environment home price depreciation (HPD).

As we enter a period of possible decline in home prices these losses accumulate first to the lowest rated tranche in an MBS or ABS security and subsequently in order to the next highest rated tranches. Those in the lowest rated tranches, the b piece, have presumably already experienced some discomfort if not some losses on their investment.

My question for you would be how far up the capital structure do you think losses will go? Will a single A investor incur losses? Does a triple A investor have reason for concern? Also, have the rating agencies done an adequate job in rating these securities? Specifically, a triple A security should carry a risk equivalent to that of US government debt. Is this the case or have the rating agencies misapplied their ratings and a triple A RMBS actually carries more risk than its supposed government security equivalent.“

I’ll start with the question at the end: “Have the rating agencies misapplied their ratings and a triple A RMBS actually carries more risk than its supposed government security equivalent?”

The answer is yes, there is more risk for an RMBS “AAA” but no, the rating agencies are not to blame. The reason is that an AAA on a Treasury and on an MBS or an ABS don’t compare. They don’t compare because the guarantee mechanism is of a different nature: the guarantee on a Treasury is a promise: it’s Uncle Sam’s word backing an IOU: it’s Uncle Sam saying: “I will pay you back!” Of course not every government has stuck to its word the way Uncle Sam intends to: Russia has defaulted, Thailand has and so has Argentina, among others. But it’s safe to say that if Uncle Sam says that he will pay you back then, for the foreseeable future, he will indeed do so. It’s a question of reputation: there is too much reputational risk at stake for Uncle Sam to renege on his word. An MBS or ABS “AAA” is altogether another kettle of fish: it’s the outcome of credit enhancement which is a mechanical process and it’s understood that there’s a possibility, however remote, that it may not work: the investor is warned in the deal’s prospectus that the borrower may default (credit risk) or choose to prepay if interest rates get lower (market risk) and that this may impact the bond’s returns. How? I’m going to show you in a highly simplified RMBS in the table below.

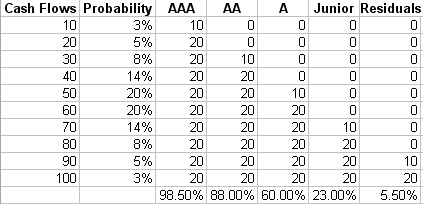

In the first column, I’ve put the various values that the cash flow can take: from $10 to $100. These extreme values for monthly cash flows are rare outcomes; the most commonly found are in the $50-$60 interval. In the second column, you’ll find the probability of the various outcomes. I’ve chosen them so they represent the normal distribution of random fluctuations around a central value (here $55): if you build a histogram on the Probability column, you’ll see that it approximates the bell-shaped curve of the normal distribution. The five next columns represent the five tranches in my deal: the three “senior”: AAA, AA and A and the subordinated parts, the “Junior” tranche and the residuals. The subordination principle is elementary: Residuals take first loss; Junior takes second loss; etc. With a cash flow of at least $60, each of the senior tranches receives the $20 they’re entitled to by the bond’s waterfall. With less than $60 they incur losses, starting with A.

The price for each tranche has been calculated in the classical way of probability theory introduced by Girolamo Cardano (1501-1576) in his Liber de ludo aleae: the sum of the possible outcomes, each of them times the probability of its occurrence.

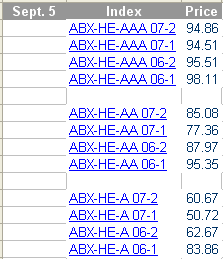

My simulation is a very simple one and I was prepared to tweak it to make it comparable with what we’re talking about here. It turns out this is not even necessary. Indeed look at the table below where I’ve brought together the current prices for the ABX index, i.e. the way the market prices ABS backed by subprime mortgages. The actual prices for AAA, AA and A are close enough to those in my simple-minded simulation to suggest we’re dealing here with a very similar principle for pricing.

Do these prices show what will happen in terms of losses on those ABSs? Maybe not, but in the current context of information about the product, this is where the market settles and in that respect the market – as always – is necessarily right. The conclusion is inescapable: yes, AA can incur losses; yes, even AAA can incur losses and in that respect no, an ABS’ AAA does not even come close to a Treasury’s own AAA which – as we’ve seen – is backed by Uncle Sam’s unwavering and dependable word.

One response to “The ABS and Uncle Sam”

The answer to this question is simple: credit ratings are not to blame. Knowing the difference between U.S. Treasuries and the risks/rewards associated with that vs. those associated with commercial paper is what is key. Tres simple.