This is a bit of a detective story, a bit of a puzzle. The method is archaeological.

This morning a colleague of mine sends me an e-mail entitled “importance of correlations.” There are several attachments. One of them is an article by Don Chance entitled “Rethinking Implied Volatility” (*). In it, the author writes the following about the Black-Scholes model for pricing financial options:

“As we said earlier, the Black-Scholes model produces implied volatilities of traded options that can vary by exercise price for a given underlying asset. How should we respond to such a finding? First, we could suggest that the Black-Scholes model is not correct. Since there cannot be more than one volatility of the underlying asset, the model must be incorrect. Case closed.”

I reply to my colleague’s e-mail, saying this:

“On the incorrectness of Black-Scholes and on the “smile” in particular (different “implied volatilities” for different strikes), I had shown on a few examples – and back in the early nineties (I should have the unpublished paper somewhere) that the smile vanishes if you split the “implied volatility” into two components a “true” implied volatility and an additional variable: the option writer’s “profit margin” – constant across strikes and easily calculated as the value that removes the smile, i.e. returns a single – correct – implied volatility.”

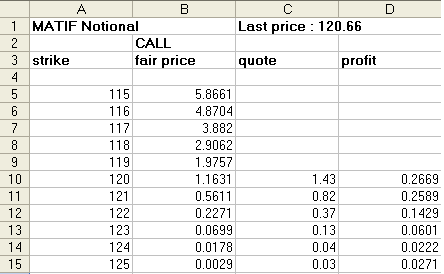

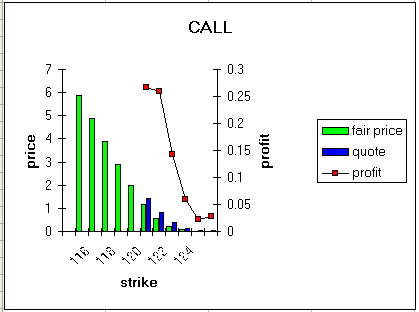

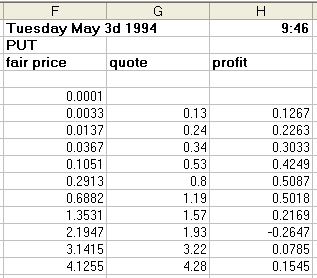

Back home, I look for that paper: I remember it was short: 2 to 3 pages, with diagrams, I can’t find it. The only thing I can find is an Excel spreadsheet with data and the diagrams. Here they are.

I find also a reference to my piece of research in a lecture I gave at ABN Amro in Amsterdam in November 1996. Here is the relevant passage:

“Actually, the fair prices calculated this way (**) are lower than those observed on the markets. This is however the case as well for fair prices calculated according to the theoretical models of Black-Scholes and Cox-Ross-Rubinstein. Prices closer to actual market prices obtain if one adds a particular constant to every one of them. This additional constant can be considered as the profit of the seller or writer of options: to his/her objective loss expectancy s/he adds a margin of actual profit. This last parameter has been overlooked in all theoretical models. When introduced it removes a well-known anomaly of prices generated by the Black-Scholes model, the volatility skew or « smile ».”

————-

(*) Don Chance, Ph.D., CFA, “Rethinking Implied Volatility,” Financial Engineering News, January/February 2003

(**) Sum of potential gains times their probabilities.

3 responses to “The smile in Black and Scholes”

I would like to inform you:

I inverted the Black Scholes formula V = V (sigma, R, K, T, S) and finally I obtained the exact formula of volatility in function of the variables observable on the market: Sigma = Sigma (V, R, K, T, S). This result was unknown during 35 years.

My formula is as true that the Black Scholes classical formula. The same way that: y = ln x and x = e^y.

Now I know that the Black-Scholes classical model allows only one volatility (respect to the Don Chance opinion), but several other models frequently used in quantitative finance admit two or more volatilities for one asset.

Sincerely. Nikolay

Pardon.

@ P.J.

a true” implied volatility and an additional variable: the option writer’s “profit margin” .

Je vais écrire mon opinion en français, a “true implied volatility” ne veut rien dire et est de plus très peu indisociable de la “profit margin” qui se doit de supporter le risuqe. Comment pouvez-vous êtes si intelligent et si “b…” à la fois ???

Je tente de m’expliquer:

Si P est très en dehors de la monnaie mais y reviens avant échéance, c’est que la volatilité réalisée aura été supérieure à votre “true implied volatility”, d’autant plus supérieur que l’option sera dans la monnaie (donc le sous jacent aura été “fortement volatile”).

Justifiant à posteriori le prix demandé par le vendeur d’options (vendeur qui en sera quand même pour ses frais) et l’existence du smile à priori.

Je suis convaincu que si vous faite une interpolation linéaire entre bid et ask (sur une même option et sur différents strike) plutôt que ce que vous vous êtes proposé de faire, vous constaterez que le smile de volatilité est encore présent.

La volatilité implicite est un estimateur (comme le prix d’une action), il n’y en a pas de “true”, il est seulement régit par l’offre et la demande. Après il est vrai que sur beaucoup d’options, l’offre et la demande sont faites par un unique market maker.

Bien cordialement.

Thank you,

very interesting article