-

Paris Defence and Strategy Forum – The Silent War and Strategic Mobilization in the Age of Infrastructure Warfare, March 12th 2025

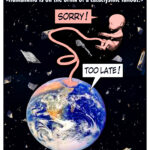

Illustration by DALL·E

Blueprint for Paul Jorion’s Speech at Panel 3: The Silent War and Strategic Mobilization in the Age of Infrastructure Warfare

War must be…

-

Mr President, with all due respect, please don’t do what you rightly accuse your opponent of doing: taking a dangerously inflated view of your current capabilities. Please withdraw from the race: we, the citizens of nations abroad, need the United States to remain a democracy.

-

This was what Brexit was preparing and enabling the British to do, by Duncan Sutherland

Last night I dreamed a dreadful dream. The world as we knew it ceased to be when a global pestilence descended upon it while its climate changed disastrously and uncontrollably. Standing among the ruins of the ancient Roman forum, the leader of the British revealed that…

Last night I dreamed a dreadful dream. The world as we knew it ceased to be when a global pestilence descended upon it while its climate changed disastrously and uncontrollably. Standing among the ruins of the ancient Roman forum, the leader of the British revealed that… -

Let us explain to Germany what we expect of it TODAY

Published here in French.

For ten years now, we have been hearing the same refrain from other European leaders to justify their procrastination towards the German authorities: “After the elections, things will be clearer”! However, from German election to German election, things are not clearer once the vote has been completed, but…

-

Catalan leaders in court facing crimes of more than 30 years in prison, by Duncan Sutherland

Guest post. Open to comments here.

Disloyalty or Dissent?

Political dissent is still evidently constitutionally defined as disloyalty in some instances in Spain. Is this a sound basis for the rule of law in a democracy? Discuss with reference to the Spanish constitution of 1978 and the founding principles of the European…

-

Scotland – “A Terrible Beauty Is Born”, by Duncan Sutherland

Guest post.

Since Sunday morning, when the First Minister of Scotland, Nicola Sturgeon, answered a question on a BBC Scotland television programme known as Politics Scotland concerning a House of Lords advice note which had been circulated on the subject of legislative consent in relation to legislation giving effect to Brexit which would have to…

-

Scotland and Brexit, by Duncan Sutherland

Guest post.

Dear Mr. Jorion,

Having read what has appeared in your blog so far about the complexities of the decision taken by the people of England on Thursday (but not by the people of Scotland), I wonder if you are yet aware of a complexity which has just been raised in Scotland today.

-

Euractiv.com, Paul Jorion : ‘Jean-Claude Juncker’s moral authority has been damaged’, 14th November 2014

Euractiv.com, Paul Jorion: ‘Jean-Claude Juncker’s moral authority has been damaged’

Does the LuxLeaks scandal represent a risk for the Commission?

Paul Jorion: Jean-Claude Juncker’s moral authority has been damaged. Of course, he hopes his investment plan will bring confidence, and it is a good idea. Especially if it can create employment and give purchasing…

-

On Europe, an answer to Mr François Hollande, president of the French Republic, by Pierre-Yves Dambrine

An English translation of Sur l’Europe, en réponse à Monsieur François Hollande, président de la République, par Pierre-Yves Dambrine by Johan Leestemaker

Invited commentary, in response of a tribune de François Hollande published today May 8 in the…

-

European Parliament, Committee on Economic and Monetary Affairs, November 5, 2013

My intervention is part of the filmed account of the session on the Parliament’s own TV channel.

-

“The future of the Eurozone from an interest rate standpoint”, European Parliament, November 5, 2013

Here my contribution to European Parliament, Committee on Economic and Monetary Affairs, November 5, 2013, 3:30 to 6:30 p.m.

The future of the Eurozone can be approached as a logical problem. If not solved, it can at least be significantly clarified when the issue is examined from the single standpoint of…

-

A mail exchange about JP Morgan’s “The Euro area adjustment: about halfway there”, Europe Economic Research, 28 May 2013

From : Paul Jorion

Object : The Euro area adjustment: about halfway there

Date : 21 June 2013 21:33:20 UTC+02:00

To : Malcolm Barr, David MackieGood day MM. Barr and Mackie,

I’m writing to you as I receive several mails drawing my attention to the following paragraph of…

-

LE SOIR, ‘The only solution is to pool all the debts’, September 4, 2012

4 September 2012

An interview with Dominique Berns which appeared today in the economy pages of the daily newspaper, LE SOIR.

“To save the Euro, we must mutually pool the debts”

Q : The president of…

-

THE ONLY REMAINING MEANS OF SAVING THE EURO

Translated from the French by Tim Gupwell

In my articles here, I generally address myself to anyone who wants to read me, but just this once, I would like to direct my address to my fellow financial engineers, and moreover in a tone – also just this once – of provocation which is…

-

PROGRESS, TOO GOOD TO BE TRUE, by François Leclerc

Guest post. Translated from the French by Tim Gupwell

When there seems no way out, and the future seems unclear, it is then that promising visions of the future seem to abound.

The Bundesbank, accompanied by all those who take their cues from it, never miss an opportunity to remind us of the…

-

WHEN WE’RE NOT MOVING FORWARDS WE’RE GOING BACKWARDS…, by François Leclerc

Guest post. Translated from the French by Tim Gupwell

The European Finance Ministers managed during the course of the night to finalize a minimal agreement, which needs, as usual, to be examined in detail due to its grey areas. They put together a set of nominations to the ECB and the ESM based…

-

GUILTY PARTIES WANTED !, by François Leclerc

Guest post. Translated from the French by Tim Gupwell

In accordance with the predictable script, the bond market is under pressure again. The cost of servicing Spanish and Italian debt has continued to increase as their financing plans move forward in little measured steps. The effect of all this is to place an…

-

THE SPANISH RISK PREMIUM

There were two bond issues today, one in Spain, the other in Denmark, which allow us to carry out an interesting little calculation of the risk premium required of Spain when it borrows on the capital markets.

A short while ago the Spanish…

-

AND NOW?

14 juin 2012 par Paul Jorion

And now? What are we going to do? Now that Spain has lost access to capital markets for its debt?

True, the downgrading yesterday evening of Spain’s rating by three notches by Moody’s, from an A3 to Baa3 has not helped…

-

SPAIN IN STORMY WATERS

12 juin 2012 par Paul Jorion

The 10 year rate for Spanish debt has just reached a historic high. On the 25th November of last year, the rate had beaten a record when it reached 6.72%. Yesterday early in the morning, when…