This article goes along with what I was writing. It turns out it was published one day earlier than my…

-

AI: How would François Chollet criticise Paul Jorion’s manuscript?

In the same vein as my AI: Are Hinton’s and Jorion’s Views on Co-Evolution Compatible? a fortnight ago. Today, this AI: How would François Chollet criticise Paul Jorion’s manuscript?.

The […]

-

AI: Are Hinton’s and Jorion’s Views on Co-Evolution Compatible?

Illustration by ChatGPT 4o

Illustration by ChatGPT 4oAI: Are Hinton’s and Jorion’s Views on Co-Evolution Compatible?

Hinton’s view on co-evolution

Geoffrey Hinton’s work implicitly sketches a re-imagining of evolution itself – one played out on silicon rather than in carbon. He often likens gradient descent to an […]

-

On the puzzling behavior of generative AIs: What to make of recent interpretations of the inner workings of Claude, Anthropic’s large language model?

Illustration by DALL·E

On March 27, 2025, Anthropic published a set of innovative analyses in its article On the Biology of a Large Language Model (LLM), constituting an in-depth exploration of the internal workings of its Claude 3.5 Haiku model. The […]

-

Video – Wow! Maya and I: Sci-Fi is Here to Stay!, March 9th 2025

Talking to the amazing new conversational tool from sesame.com

-

Paris Defence and Strategy Forum – The Silent War and Strategic Mobilization in the Age of Infrastructure Warfare, March 12th 2025

Illustration by DALL·E

Blueprint for Paul Jorion’s Speech at Panel 3: The Silent War and Strategic Mobilization in the Age of Infrastructure Warfare

War must be avoided at all costs. However, our desire for peace is no guarantee against aggression from an […]

-

“JESUS vs DONALD” #JvsD

Trumpism is no political system, it’s a cult: the cult of brute force, the cult of “If you’re not like me, i.e. a Straight White Rich Guy, go fuck yourself!”.

You don’t fight a cult with arguments, you fight it with a better cult: the cult of generosity, of openness of the heart, of compassion, […]

-

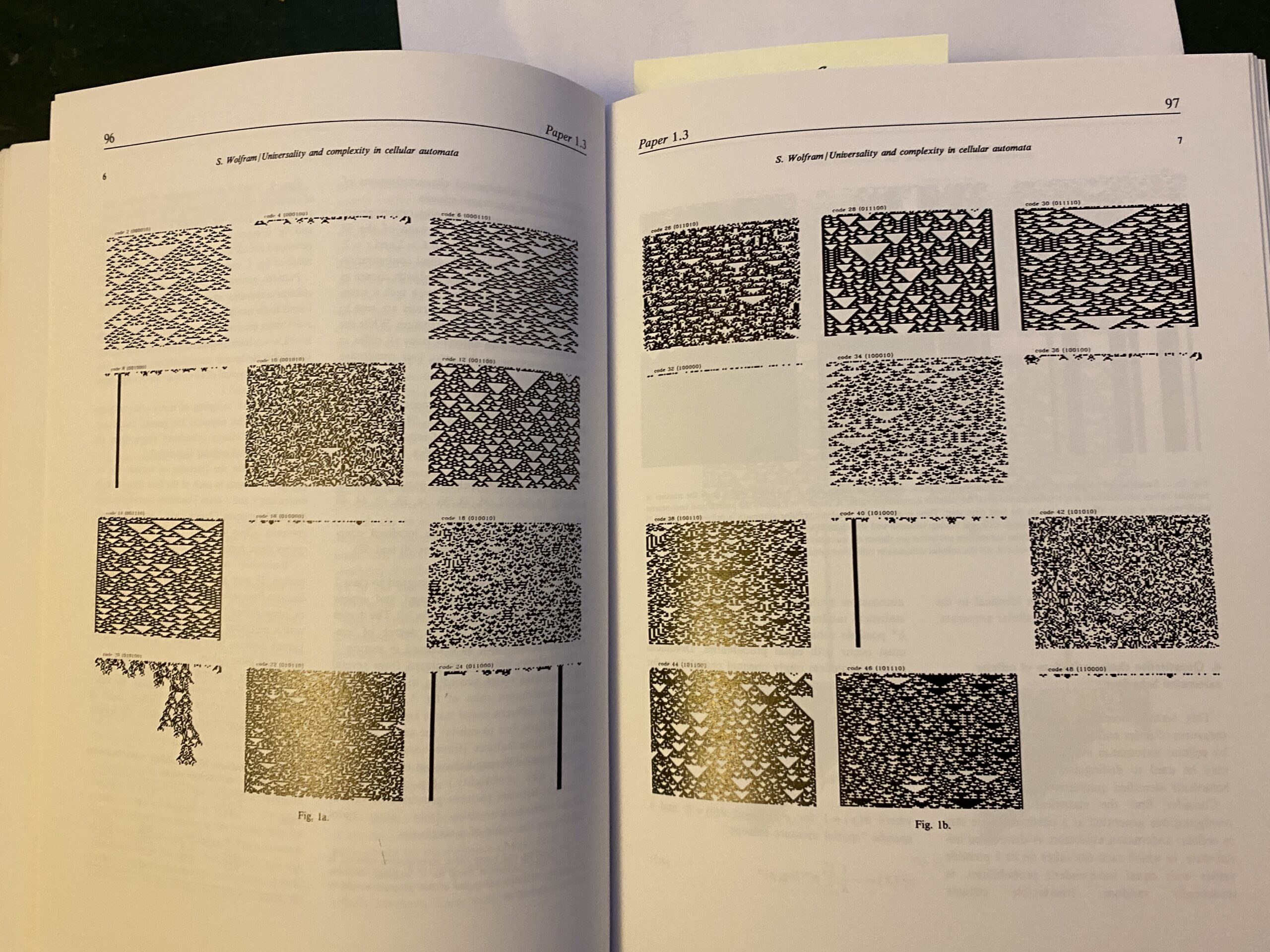

A Stephen Wolfram Tribute

Dog cockle, Glycymeris glycymeris

Stephen Wolfram, “Universality and Complexity in Cellular Automata”, Physica 10D (1984), 1-35

Contact Paul Jorion

Most recent comments

LLMs deal essentially with language but seems amenable to graphics as well. To such an extent that one may wonder…

“the marvellous powers of the brain emerge not from any single, uniformly structured connectionist network but from highly evolved arrangements…

When the entangled narrative is based on the Bible, the problem is the Bible.

I intend to read the Krichmar paper, thanks for mentioning it. I looked in my library, I’ve got a 1987…

It’s becoming clear that with all the brain and consciousness theories out there, the proof will be in the pudding.…

Do Androids dream of electric sheeps ? Yes. Thanks Paul.

You say that A machine with only primary consciousness will probably have to come first. That’s the way evolution proceeded:…

It’s becoming clear that with all the brain and consciousness theories out there, the proof will be in the pudding.…

I fear your views of AI are pretty much outdated. They pre-date in any case neural networks. What you are…

Most recent posts

- AI: How would François Chollet criticise Paul Jorion’s manuscript?

- AI: Are Hinton’s and Jorion’s Views on Co-Evolution Compatible?

- On the puzzling behavior of generative AIs: What to make of recent interpretations of the inner workings of Claude, Anthropic’s large language model?

- Video – Wow! Maya and I: Sci-Fi is Here to Stay!, March 9th 2025

- Paris Defence and Strategy Forum – The Silent War and Strategic Mobilization in the Age of Infrastructure Warfare, March 12th 2025

My books

Topics

- "Who Were We?"

- A NEW "US" FOR NEW TIMES

- Anthropology

- Art

- Artificial Intelligence

- Blog

- Brexit

- China

- Computing

- Currency

- Democracy

- Ecology

- Economy

- Essential questions

- Europe

- Extinction threat

- Finance

- Fine arts

- Fiscality

- Fukushima

- Fun

- History

- Human complex systems

- Internet

- Labour

- Law

- Libor

- Literature

- LLM

- Mathematics

- Mystery

- Nonsense

- Pandemic

- Philosophy of science

- Physics

- Politics

- PROTEST MOVEMENTS

- Psychoanalysis

- Scotland

- Sociology

- Spain

- Stewardship of Finance

- Subprime

- The Singularity

- Transhumanism

- United Kingdom

- United States

- Unspecified

- War

Tags

"L'avènement de la Singularité" "Thought as Word Dynamics" ANELLA A NEW "US" FOR NEW TIMES Angela Merkel Aristotle Artificial Intelligence balanced budget rule Barclays Brexit capitalism Chair "Stewardship of Finance" Claude 3 debt Donald Trump ECB EFSF ESM Europe eurozone France FSA Germany GPT-4 Greece Herman Van Rompuy IMF Italy Jean-Claude Juncker José Manuel Barroso Large Language Models LIBOR linguistics LLM Mario Draghi Mario Monti Pribor.io problem solving Proudhon P vs NP Spain speculation The Singularity Troïka United States